The entrepreneurs we encourage

thinc.capital aims to build a quality portfolio with consistent fundamentals.

Pentahold

Where industry meets finance

thinc.capital joined forces with 4 entrepreneurial investors to found Pentahold. Pentahold takes majority or substantial minority stakes in midsize companies.

Volta Ventures

Investing in promising start-ups.

thinc.capital invests in Volta Ventures to support start-ups & young growth companies in the internet and software industry.

Maxus

Entrepreneurial Private Equity Platform.

thinc.capital co-founded and invests in Maxus to build enduring partnerships with leading and emerging small- & mid cap private equity managers.

Amavi

Innovator in real estate.

thinc.capital co-founded and invests in AMAVI to support growth of the leading and most promising scale-ups active in the PropTech industry.

Hyloris

Added value for existing medication.

thinc.capital invested in Hyloris at the moment of the IPO and has been a shareholder since.

ION

Develop Different.

thinc.capital co-founded ION in 2011 with 2 bright & dedicated entrepreneurs. We continue to focus on realizing our growth ambitions, both in Belgium and abroad.

Deceuninck

Innovative window and door solutions.

Paul Thiers was a member and chairman of the Board of Deceuninck. thinc.capital invests in Deceunick as we believe Deceuninck is well placed to profit from the renovation wave.

Noven

Renewable energy for buildings.

thinc.capital co-founded Noven and financially & strategically supports the bright entrepreneurs behind Noven. Together, we want to develop the optimal energy solution for your building.

Furnibo

Building partner from brainstorm to delivery.

In 2014, thinc.capital supported the management buy-out of Furnibo. Together with the dedicated entrepreneur behind Furnibo, we realized (and continue to realize) the strong growth ambitions of the company.

Altior

High profile talent recruitment.

thinc.capital co-founded Altior together with experienced HR entrepreneurs. Together, we managed to become a leading executive search company in Belgium.

Amanoi

Five star luxury resort in Vietnam.

In 2008, thinc.capital started the construction of Amanoi together with like-minded entrepreneurs. With sustainable local partnerships, this beautiful luxury resort has been realized and has already won numerous awards.

Iristick

Smart glasses for industrial use.

In order to support Iristick's growth plan, thinc.capital subscribed to a funding round in 2017.

ROOV

The app that saves you money.

In order to support ROOV's growth plan, thinc.capital subscribed to a funding round in 2021.

Arctic Fox

Addressing the growing demand in aesthetic medicine.

In order to support Arctic Fox' strong growth, thinc.capital subscribed to a funding round in 2021.

Urban Crops

Hyper efficient indoor farming.

thinc.capital supports the growth of Urban Crops Solutions. In 2016, Paul Thiers joined the Advisory Board of Urban Crops Solutions.

Tioga Capital

Blockchain technology.

thinc.capital invests in Tioga to support the growth of promising blockchain start-ups and to get insight in the European blockchain ecosystem.

Hummingbird

Venture Capital.

thinc.capital invests in Hummingbird to support the growth of the tech companies of tomorrow.

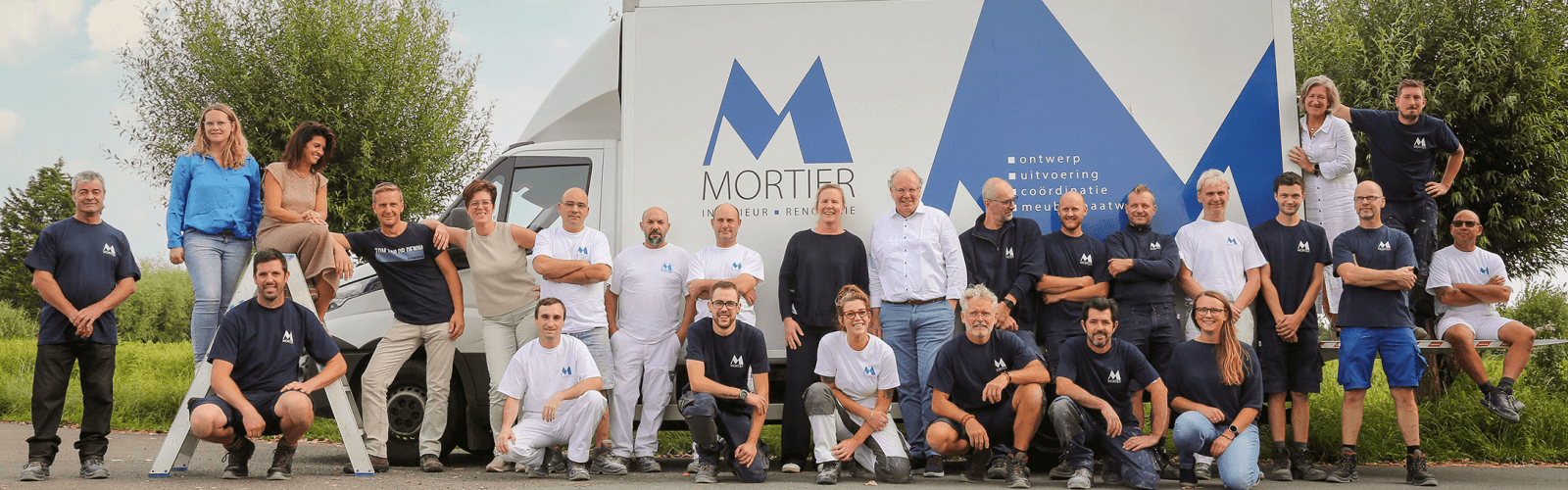

Mortier

Specialist in renovation & refurbishment.

In 2022, thinc.capital invested in Mortier. Together with our partners, we aim to take Mortier to the next level with committed industry experience and financial resources.

MM Estate

Delivering outstanding projects for the next generation.

thinc.capital supports the 2 ambitious entrepreneurs behind MM Estate. Together, we aim to deliver outstanding projects based on a combination of expertise, committed industry experience & financial resources.

Decat

Technical integrator and service provider

In 2022, thinc.capital invested in DECAT (empowering places). Together with the CEO Lieven Decat, we aim to take the company to the next level with committed industry experience and financial resources.

Bright Energy

Sustainably power your construction site while saving cost.

thinc.capital invested in Bright Energy to disrupt the energy management solutions for construction.

PowerBee

Above and Beyond Energy.

thinc.capital invested in PowerBee to guide companies through their energy transition.

BYGG

A space only has value when people value it.

thinc.capital supports BYGG in building high-quality real estate projects with a focus on sustainability.

NØDGE

Signature Retreats.

thinc.capital supported NØDGE to merge sustainability and aesthetics in a refreshing and high-end housing concept where the resident's experience and contact with their surroundings is central.

Atelier Vierkant

Handmade in Belgium, Unique Wordwide.

thinc.capital invested in Atelier Vierkant to support the growth of a globally unique ceramic studio that blends art, architecture, and craftsmanship into timeless design.

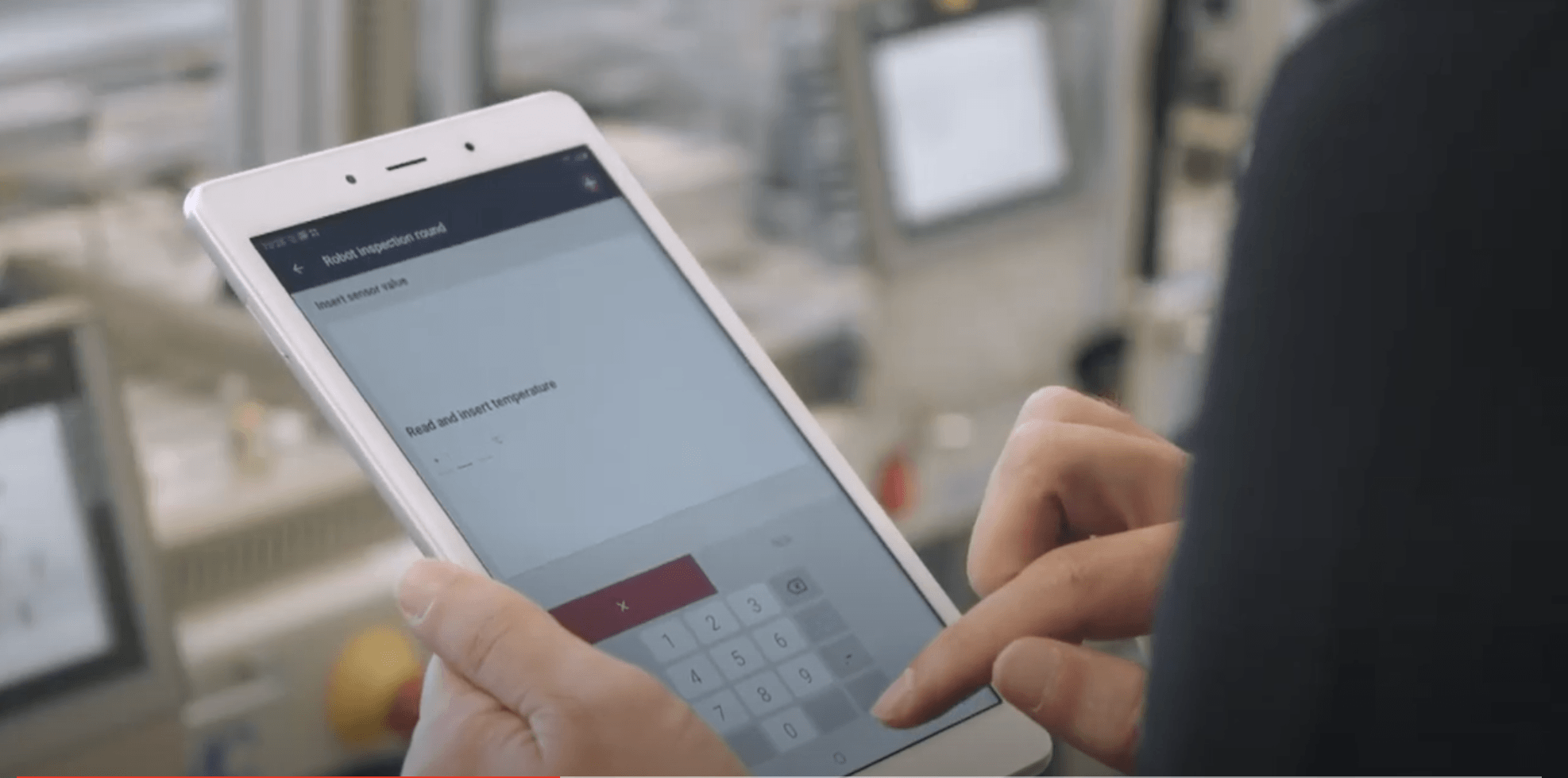

Proceedix

The digital revolution for work instructions and procedures.

In order to support Proceedix' growth plan, thinc.capital subscribed to a funding round in 2017. In December 2021, Proceedix has been successfully sold to Symphony Industrial, a leading enterprise AI company for digital transformation.

Verhulst

Aluminum & Wood.

thinc.capital supported a management buy-out by the 3rd Verhulst generation. Together, we worked to take Verhulst to the next level with committed industry experience and financial resources - enabling the company to realize its growth ambitions.

Following this successful phase of development (more than tripling the EBITDA in less than 5 years), Verhulst was confidently transitioned back to its management team: a win-win for both parties and a testament to the company’s operational excellence.

March

The disruptive real estate companion.

thinc.capital co-founded March and financially & strategically supported the dedicated entrepreneur behind March. Together, we set out to streamline and disrupt the commercial real estate brokerage model.

After a period of growth and successful collaboration, we proudly sold March back to its management team: a win-win for both parties that marks a successful next chapter for the company and its founder.

Typhoon

Craftmanship in air technology.

thinc.capital supported the management buy-out of Typhoon in 2010. After 4 years of closely working together and realizing significant growth, thinc.capital successfully sold their stake back to management in 2014.

Origis Energy

Clean energy within reach.

As a strong believer in renewable energy, thinc.capital co-founded Origis Energy in 2008 with the current management. After achieving rapid & impressive growth, Origis became a top 5 player in the US and was sold to management backed by Global Atlantic (part of KKR).

Unilin

Smart living solutions since 1960.

Paul Thiers started at Unilin in 1982 and was co-CEO & shareholder of the Unilin Group until the sale to Mohawk Industries in 2005.