MM Estate

Delivering outstanding projects for the next generation.

MM Estate Group stands for exclusive and sustainable living in prime locations. Based on a strong passion for refined architecture, special use of materials and a sense of space, MM Estate Group designs a living experience that is always unique and different.

MM Estate Group creates exclusive living experiences where architecture and interior go hand in hand with living, working and relaxing. Value is added by meaningfully combining people, planet and business in order to achieve a future-proof result.

Discover related investments

Altior

High profile talent recruitment.

thinc.capital co-founded Altior together with experienced HR entrepreneurs. Together, we managed to become a leading executive search company in Belgium.

Amanoi

Five star luxury resort in Vietnam.

In 2008, thinc.capital started the construction of Amanoi together with like-minded entrepreneurs. With sustainable local partnerships, this beautiful luxury resort has been realized and has already won numerous awards.

Arctic Fox

Addressing the growing demand in aesthetic medicine.

In order to support Arctic Fox' strong growth, thinc.capital subscribed to a funding round in 2021.

Atelier Vierkant

Handmade in Belgium, Unique Wordwide.

thinc.capital invested in Atelier Vierkant to support the growth of a globally unique ceramic studio that blends art, architecture, and craftsmanship into timeless design.

Bright Energy

Sustainably power your construction site while saving cost.

thinc.capital invested in Bright Energy to disrupt the energy management solutions for construction.

BYGG

A space only has value when people value it.

thinc.capital supports BYGG in building high-quality real estate projects with a focus on sustainability.

Decat

Technical integrator and service provider

In 2022, thinc.capital invested in DECAT (empowering places). Together with the CEO Lieven Decat, we aim to take the company to the next level with committed industry experience and financial resources.

Furnibo

Building partner from brainstorm to delivery.

In 2014, thinc.capital supported the management buy-out of Furnibo. Together with the dedicated entrepreneur behind Furnibo, we realized (and continue to realize) the strong growth ambitions of the company.

ION

Develop Different.

thinc.capital co-founded ION in 2011 with 2 bright & dedicated entrepreneurs. We continue to focus on realizing our growth ambitions, both in Belgium and abroad.

Iristick

Smart glasses for industrial use.

In order to support Iristick's growth plan, thinc.capital subscribed to a funding round in 2017.

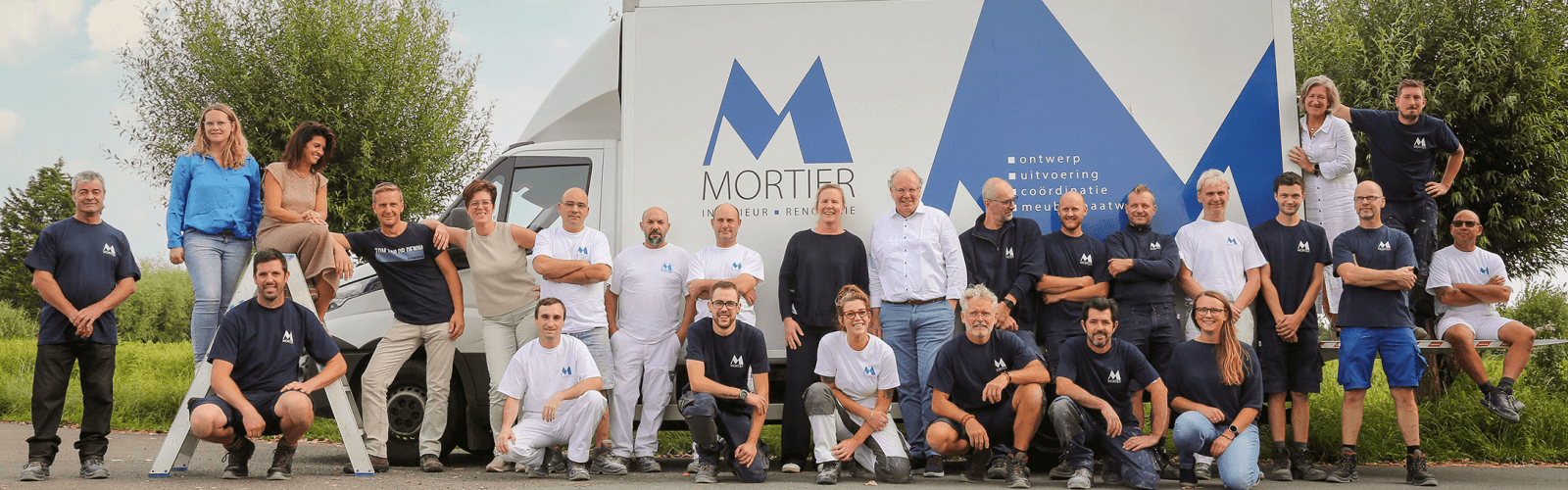

Mortier

Specialist in renovation & refurbishment.

In 2022, thinc.capital invested in Mortier. Together with our partners, we aim to take Mortier to the next level with committed industry experience and financial resources.

NØDGE

Signature Retreats.

thinc.capital supported NØDGE to merge sustainability and aesthetics in a refreshing and high-end housing concept where the resident's experience and contact with their surroundings is central.

Noven

Renewable energy for buildings.

thinc.capital co-founded Noven and financially & strategically supports the bright entrepreneurs behind Noven. Together, we want to develop the optimal energy solution for your building.

PowerBee

Above and Beyond Energy.

thinc.capital invested in PowerBee to guide companies through their energy transition.

ROOV

The app that saves you money.

In order to support ROOV's growth plan, thinc.capital subscribed to a funding round in 2021.

Urban Crops

Hyper efficient indoor farming.

thinc.capital supports the growth of Urban Crops Solutions. In 2016, Paul Thiers joined the Advisory Board of Urban Crops Solutions.

Impressive growth stories

Flanders Make bouwt toptechnologisch centrum in Kortrijk

In Kortrijk staat een derde centrum voor toptechnologisch onderzoek in de steigers. In het nieuwe gebouw worden vanaf het najaar van 2022 de nieuwste industrie 4.0 technologieën en productiewerkwijzen uitgetest. Ondernemingen zullen er ontdekken hoe ze op een laagdrempelige manier optimaal kunnen investeren in hun eigen productieomgeving voor de toekomst. Het centrum wordt ontwikkeld door ION en Stadsbader, die heel hard inzetten op duurzame technieken.

Noven: duurzame energie als een service

Als we in Europa tegen 2050 CO2-neutraal willen zijn, moeten we in België dringend onze gebouwen aanpakken. Ze zijn de grootste bron van CO2-uitstoot, zegt Jeroen Rabaey, medeoprichter en co-CEO van Noven. Noven is één van de duurzame investeringen van thinc.capital. De Gentse start-up is specialist in de productie van duurzame energie voor bestaande appartementsgebouwen en partner voor nieuwbouwprojecten.